Some Known Questions About Short Term Loan.

Wiki Article

What Does Short Term Loan Do?

Table of ContentsA Biased View of Short Term LoanThe smart Trick of Short Term Loan That Nobody is Talking AboutHow Short Term Loan can Save You Time, Stress, and Money.Some Known Questions About Short Term Loan.

The Office of Student Financial assistance has funds readily available for temporary car loans to help pupils with temporary capital issues. Short-term finances are available only to trainees that are currently participating in the college (fundings can not be processed in between quarters) - Short term loan. Pupils who are bookkeeping training courses or those enrolled however not gaining credit ratings are not eligible for temporary financings.If you have any kind of questions, really feel complimentary to speak to a therapist in the Workplace of Pupil Financial Help, 105 Schmitz Hall, or call 206-543-6101. College of Washington students may have the ability to obtain a short-term financing for tuition, publications, or other expenses if they: Are registered in regular credit-earning classes in the UW Student Database Do not have an exceptional temporary financing Have a great repayment record on any kind of prior temporary financing(s) (no greater than two late settlements) Have a method of repayment by the next quarter Any prior short-term lendings have to be paid in full prior to an additional lending can be gotten.

$2,500 for Undergraduates $3,200 for Graduate/Professional students There is no interest, but a service cost of $30 will certainly be included to the settlement quantity for every funding. Late charges as well as collection prices will certainly be analyzed otherwise paid by the due day. Funding profits might be applied directly to your tuition account, disbursed directly to you, or a combination of both.

What Does Short Term Loan Mean?

my review here

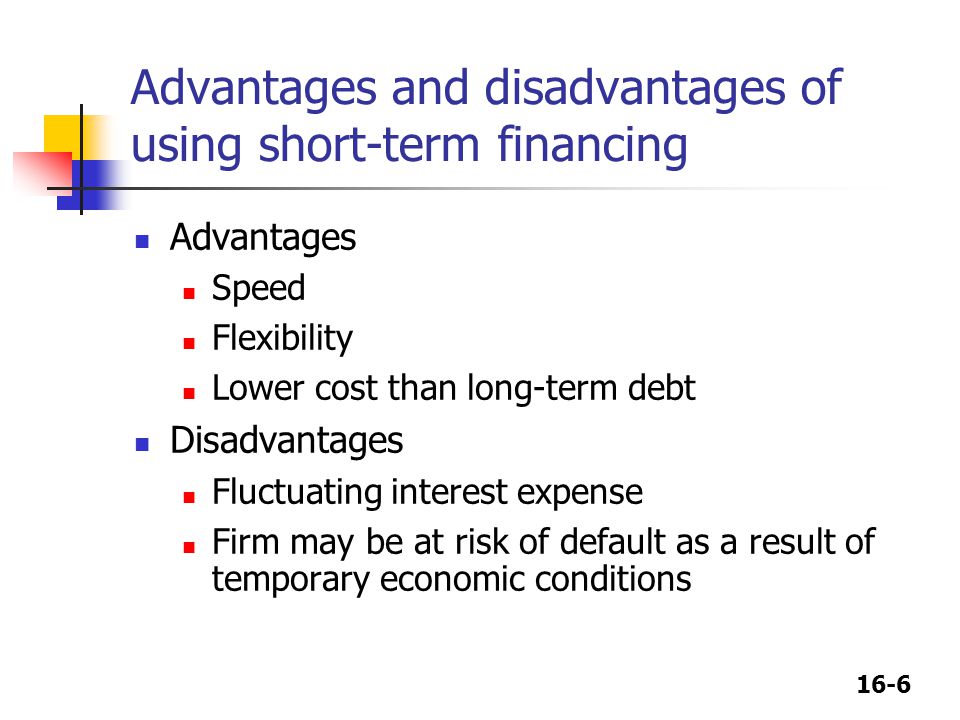

When it pertains to service loans, the size of your individual service funding term is practically as essential as securing funds. Almost all organizations call for extra capital eventually, yet there's a huge difference between lasting finances as well as short-term funding options, otherwise called short-term finances. A lot of short-term bank loan are paid back within a year or much less, yet some long-lasting car loans can last over a decade.

Unlike long-term loans, brief term financings do not featured the danger of accumulating huge financial debts or interest and do not have the long-term dedication to car loan repayments. A brief term finance can provide the right quantity of cash for your business while permitting you to pay off the lending quickly.

Not known Factual Statements About Short Term Loan

Temporary finances come in convenient when you have an emergency situation however are in a monetary repair. Most, if not all, lenders in South Africa deal short-term loans.Some financial purposes have actually these fundings repaid in weeks or months. Due to their non-collateralized nature, temporary car loans usually draw in greater my latest blog post rate of interest prices as well as usually have other costs.

A lot of financial organizations in South Africa allow you quickly get this funding online. You only require to provide the lending institutions with a Proof of revenue, ID and various other required credit info. It's critical to examine the terms, rate of interest, settlement schedule, as well as other finance info prior to submitting your application.

Failing to settle in time may lead to an unfavorable credit rating score. Short-term fundings are commonly due in weeks or months. Like any kind of various other economic, bare minimums have to be fulfilled for you to certify for a temporary loan. Here are the called for documents South African lending institutions request for when allying for lendings under this category: A copy of the National ID Proof on income Evidence of houses They are various types of short-term car loans in South Africa.

The Short Term Loan Diaries

Obtain transparently with Flexible Fundings. Obtain transparently with Adaptable Car loans. On-line loans fit in this category of debt.On the internet finances draw in high-interest prices with brief settlement durations. Tiny economic service companies normally provide cash money finances in South Africa.

Cash money finances enable you to rapidly arrange out various other financial obligations also when you are on low cash. Below are some benefits of obtaining a temporary car loan: Short-term financings are conveniently accessible to small businesses as well as private view publisher site customers.

Report this wiki page